A cross-sector initiative to drive infrastructure system change by 2030

Pledge

We, the undersigned, recognize the need to significantly step-up action and accelerate implementation of sustainable infrastructure in support of the Paris Agreement’s objectives and the Sustainable Development Goals (SDGs). We hereby announce our commitment to establish a cross-sector sherpa group – Infrastructure for Future (Infra4Future) – that brings together change leaders from the public, private, and civil society sectors to co-create, promote, and deploy transformative initiatives in order to accelerate the transition to sustainable infrastructure.

Infrastructure is the backbone of climate action and a key enabler of sustainable development. Without low-carbon, high-resilience infrastructure, it will not be possible to deliver on the SDGs. Today about 70% of global greenhouse gas emissions come from the construction and operations of infrastructure. By 2035 global infrastructure is expected to more than double, making it imperative to develop low-carbon, resilient and sustainable infrastructure. Developing countries are set to expand their infrastructure as large portions of their population still lack access to basic infrastructure services such as energy, housing, water, sanitation, transport and more. Developed countries have ageing infrastructure that needs to be adapted, updated or replaced. A recent World Bank study found that an additional 100 million people will live in poverty due to climate change by 2030 if countries fail to address these challenges.

The world is on track to exceed its carbon budget and lock in a 1.5°C warming in fewer than 12 years. When it comes to infrastructure-related climate action, however, the window of opportunity is shorter. Once an infrastructure project is financed and built, its resulting emissions will be locked in for the entire project lifecycle, ranging from 20 to 40 years on average. Choosing the right type of infrastructure investment will be crucial to eradicate poverty and achieve the SDGs.

Our common future will be largely determined by the infrastructure decisions and the action we will take in the next few years. Infrastructure is the single most important lever for sustainable development. It is time to seize this historical opportunity to accelerate the transition to sustainable infrastructure.

We commit to join efforts and diligently explore the relevant climate infrastructure agenda items (see below).

We, the undersigned, commit to collaborating diligently with a goal of finalizing the terms and structure of Infra4Future by the first quarter 2020.

The signatories are committed to explore the relevant climate infrastructure agenda items*:

1. Developing metrics for sustainable infrastructure**.To effectively address climate change and sustainable development, an estimated USD 90 trillion of investment in sustainable infrastructure is required globally by 2030. The world needs to re-direct, top-up and mobilize at least $6 trillion to be invested annually in sustainable infrastructure until 2030.

Long-term investors could play a crucial role in closing this gap. However, there are uncertainties about the boundaries of sustainable infrastructure assets. This slows down or limits investment decisions of long-term investors, resulting in missed opportunities. While there are several standards and metrics developed and developing for measuring the impact of infrastructure from national, subnational and institutional investor perspectives, these disparate standards must be reconciled.

With systematized standards and metrics for sustainable infrastructure, long-term investors will be able better to understand investment risk and the opportunity for impact, allowing them to deploy faster and at larger scale – helping unlock trillions of dollars in sustainable infrastructure investments.

Innovation in methodologies and technology can also play an important role in facilitating data collection, improving analysis of unstructured datasets, as well as reducing costs of monitoring, reporting and verification.

2. Scaling-up successful models. Under a business-as-usual scenario, infrastructure development will account for a major increase in global emissions by 2030 driven by both developed countries (with ageing infrastructure that needs to be adapted, updated or replaced) and developing countries (with goals to rapidly expand their infrastructure) in the context of global population growth and increased urbanization.

In developing countries, in particular, the mobilization of private investment in sustainable infrastructure is discouraged by high investment risks associated to technical, regulatory and financial barriers. The existence of transparent regulatory frameworks and robust policies at a local level must be supported by an international financial system aligned with sustainable development, willing to provide proper long term de-risking mechanisms. Multilaterals and National Development Banks have proven to have a key role in stimulating private investment in both the Global South and the Global North.

Advances in poverty alleviation will only be sustained if climate change is halted and its impacts addressed through innovative policies linked to the design of long-term infrastructure programs. These types of initiatives need to be adopted by governments avoiding any conflict of interest that would inhibit the fulfillment of these objectives.

To foster replication and scaling-up of these successful models across different regions, there is a need to identify critical barriers and success stories, exchange best practices, and boost South-South-North cooperation in order to strengthen institutional capacity and help de-risk investment in sustainable infrastructure that is aligned with Nationally Determined Contributions (NDCs) and the SDGs.

3. Unlocking investment in sub-national infrastructure. Cities are conglomerates of infrastructure, people, and land with different uses. Most end-users of infrastructure services (e.g. buildings, energy, transport, water, telecom) live in urban areas. According to the United Nations, 70 to 80% of both adaptation and mitigation solutions are addressable at the sub-national level.

However despite overwhelming demand for low carbon, resilient, sustainable infrastructure projects that serve urban areas, these are not emerging at the scale that one would expect. Projects are most often too small to attract the skills and resources necessary to develop and implement them. Furthermore, local and national regulations are often ill-adapted to creating predictable investment environments, and local and national institutions are not equipped to oversee project development and implementation.

To unlock and scale-up investment, sub-national governments must work hand-in-hand with national authorities, technology providers, developers, businesses, and investors to overcome barriers to implementation. Sub-national authorities must equally work with citizens to better identify problems and solutions.

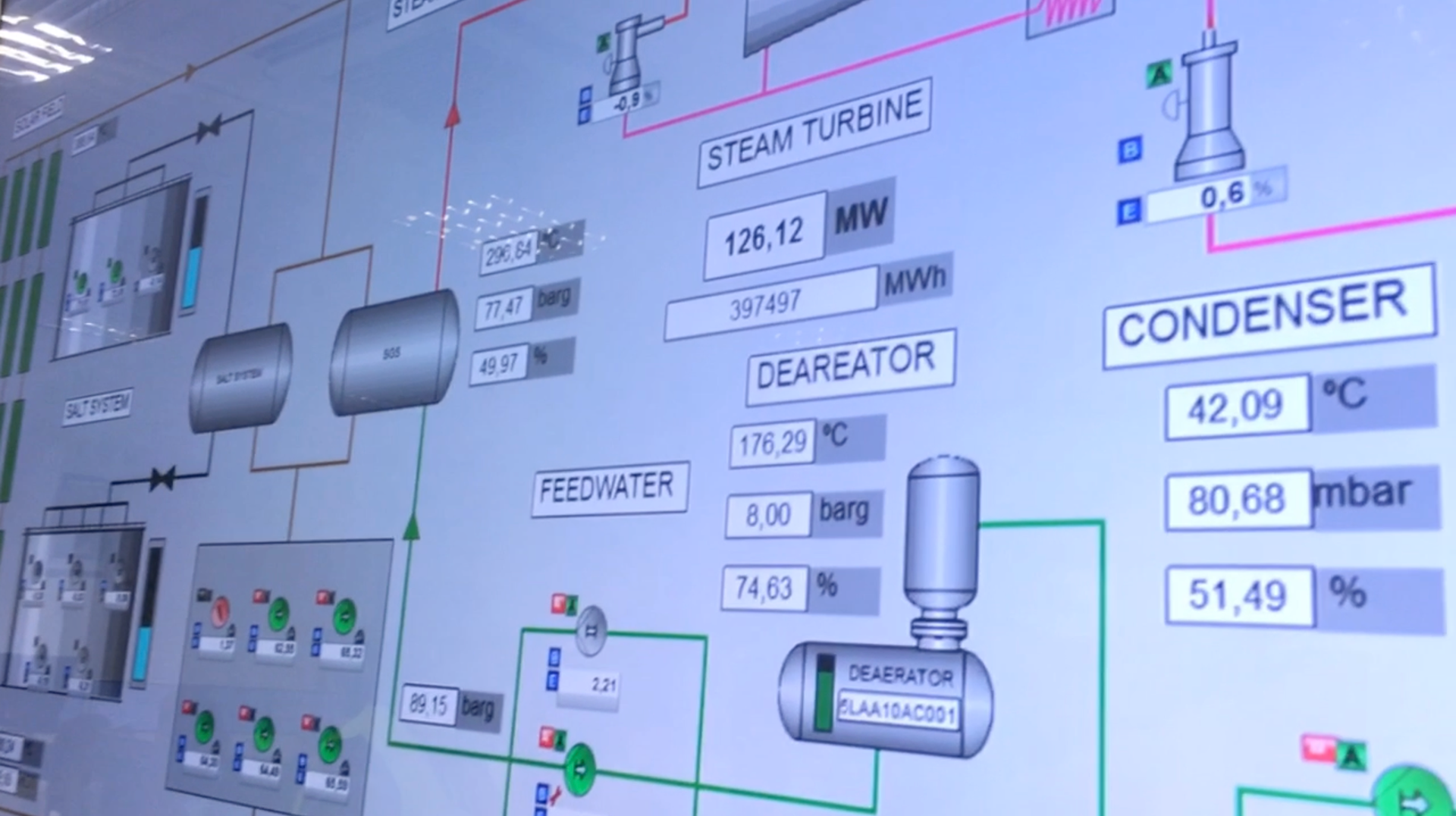

4. Anticipating disruptive technologies, synergies, and business models. Disruptive technologies and business models can drive new opportunities and challenges across the infrastructure space. Anticipating the future of technology is necessary in order to mainstream climate concerns, identify cross-industry synergies and cross-stakeholder collaboration, as well as envision circular/integrated solutions.

Innovation does not come only in technology. With key trends such as decarbonization, digitalization, decentralization, disaster resilience, electrification and urbanization, it is equally imperative to rethink business models and shape the future of infrastructure assets and services accordingly. Innovative business models can factor in the benefits of low-carbon, high-resilience infrastructure.

* The signatories will build on the existing data and resources such as the Intergovernmental Panel on Climate Change (IPCC), the New Climate Economy Report 2016, the IDB Sustainable Infrastructure Framework, the OECD Financing Climate Futures Report, The World Bank Group Beyond the Gap Report, the Task Force on Climate-related Financial Disclosures, the G20 global infrastructure initiative, the Green Bond Pledge, The Investor Agenda, ISO Standards and SDGs, SDGs Indicators, the Climate Bonds Standards, the Green Bond Principles, green bond definitional products including Moody’s, S&P Global Markets, and Bloomberg/MSCI/Barclays.

** Building on the IDB Sustainable Infrastructure Framework, sustainable infrastructure is defined as “infrastructure projects that are planned, designed, constructed, operated, and decommissioned in a manner to ensure economic and financial, social, environmental, and institutional sustainability over the entire life cycle of the project”. The Climate Infrastructure Forum 2019 also emphasized “the need for low-carbon, resilient (to the climate and other natural disaster risks), inclusive (accessible and affordable), quality infrastructure – with a focus on assets, services, and people”.

Sherpa Group

Photo credits: Sant Pau Foundation; Climate Infrastructure Partnership

About CLIP

The Climate Infrastructure Partnership (CLIP) is an international nonprofit organization for public-private-people cooperation on sustainable infrastructure.

Partnering with the public, private and civil society sectors, we help turn the Paris Agreement, the Sustainable Development Goals, and the Addis Ababa Action Agenda into sustainable infrastructure assets and services.

Headquarters

Sant Pau Art Nouveau Site

C/ Sant Antoni Maria Claret, 167

08025 Barcelona, Spain

C/ Sant Antoni Maria Claret, 167

08025 Barcelona, Spain